Who cares about last Friday’s CARES Act?

We have a lot to cover in this Periscope with the changes from Friday’s huge legislation. These include:

- No RMDs from retirement accounts in 2020

- A new $300 charitable deduction

- Unlimited charitable deduction possibilities

- Covid-19 victims may make distributions and loans from retirement accounts

- Potentially big savings for business owners

The CARES Act is huge

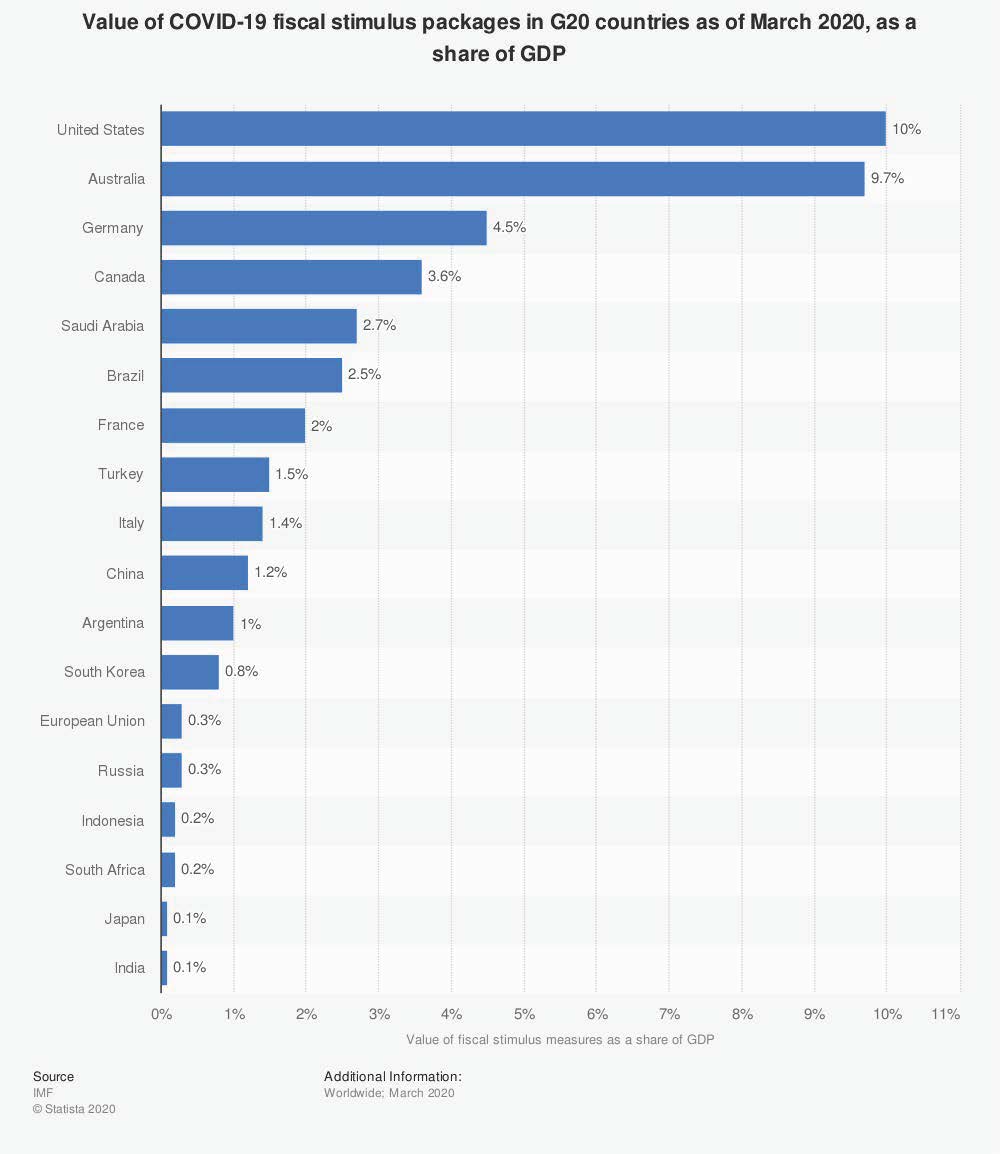

The CARES Act is the largest amount of money the US Federal Government has ever spent at a single time, and it is the largest Covid-19 response (by dollars) of any country in the world (1).

The biggest amount of money, in absolute terms, goes to business (2).

Individuals have several new financial choices to make, described next.

No Required Minimum Distributions in 2020

CARES Act suspends required minimum distributions in 2020. Folks of a certain age, who normally are forced into taking required distributions from retirement accounts, get a tax break. Folks with a beneficiary (inherited) IRA also benefit—no forced distribution in 2020!

If you have already taken your RMD for 2020, contact your financial advisor to see how you can return the funds to your IRA, should choose to do so. You’ll be moving money back in after the decline so it might be good timing!

Qualified Charitable Contributions of $300

If you’re filing a standard, simple tax return, you now get a $300 above-the-line deduction for your charitable contributions beginning in 2020. This benefit has no deadline. So, make your donations to charity! To do this, it must be a cash donation and cannot be made into a Donor Advised Fund (DAF). Previous tax reforms did away with this benefit unless you itemized your expenses. The CARES Act makes a $300 charitable deduction available to non-itemizers. Talk to your financial advisor!

BIG Charitable Contributions

If you’re interested and able to make a very large charitable contribution, 2020 is your year. You can completely wipe out your income with charitable contributions in 2020. 100% of your deduction may offset AGI (adjusted gross income) in the year 2020. Similar to the previously mentioned charitable benefit, you may not make this contribution to a DAF, but must make a donation to a charity. Make sure to talk to your financial advisor about this one if you’re interested.

Retirement plan distributions for Covid-19 victims

If you or someone you know are having a hardship related to the Coronavirus, make sure to talk with your financial advisor about the CARE Act’s special rules for distributions from retirement accounts. The list of requirements is long. If you qualify you may be able to withdraw up to $100,000 from your retirement account and avoid the 10% penalty tax, the mandatory tax withholding, spread the income tax liability over the next three years, and start a 3-year payback plan. This is much more lenient than it used to be. Note, this benefit is just for Covid-19 victims and family members.

Covid-19 retirement plan loans

Similarly, if you or a loved one needs to make a loan from your retirement plan, then 2020 may be the year to do so. The rules have been relaxed so that you may pull out 100% of the vested account value and delay repayments for up to a year. So…if you’re feeling it, you’ll want to talk with your financial advisor to see if your retirement plan can ameliorate some of the pain.

Recovery rebate advances

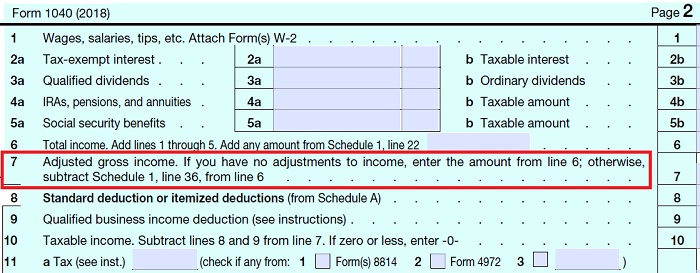

The US Federal government is issuing checks to tax-payers. Up to $1,200 per adult plus $500 per child, depending upon your (most recently filed) adjusted gross income, is available. You can find AGI on the first page of your 1040, as shown:

The IRS will issue the check based off your most recent taxable income, either 2018 or 2019. When you file your 2020 return, the IRS will reduce your taxes if your income has decreased. Or, if your income increased, then they will increase your tax liability. In any event, you’ll receive the check before you know exactly what your 2020 income will be.

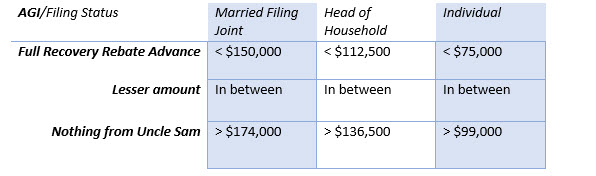

If you don’t have dependent children under age 18, then the following chart summarizes the size of your recovery rebate check (3):

If you still have children at home and you earn more than the amounts in the chart above, then your “phase out” is larger. If your dependent is age 18 or older, you both lose out—neither you nor the child gets a rebate check.

In any event, feel free to call your financial advisor for the details of your situation.

Business Owners

The largest benefits, by absolute dollars, go to businesses, both large and small. Our friend, Mike Miller CPA, put together an extensive list of resources on his website (4). If you’re interested in learning more about what this might mean for you and your company, please contact your financial advisor soon. These benefits could be huge!

Sources verified December, 2023:

(1) https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#A

(4) https://www.mmillercpa.com/resources/

Information presented above does not constitute tax advice. Always consult your own tax accountant, CPA, or the IRS web site before taking any actions that may result in tax consequences.

Help Center

Help Center