A required minimum distribution (RMD) is the annual amount that must be withdrawn from a traditional IRA or a qualified retirement plan (such as a 401(k), 403(b), and self-employed plans) after the account owner reaches the age of 72,

The last date allowed for the first withdrawal is April 1 following the year in which the owner reaches age the required beginning age.

At what age do I have to start my required distribution from my IRA?

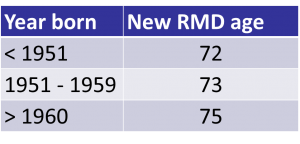

The first year you have to start a required minimum distribution from an IRA is called the Required Beginning Age. The required beginning age used to be 72, but now it has changed depending upon the year of birth.

Some employer plans may allow still-employed account owners to delay distributions until they stop working, even if they are older than that age. RMDs are designed to ensure that owners of tax-deferred retirement accounts do not defer taxes on their retirement accounts indefinitely.

You are allowed to begin taking penalty-free distributions from tax-deferred retirement accounts after age 59½, but you must begin taking them after reaching the required beginning age. If you delay your first distribution to April 1 following that year, you must take another distribution for that year. Annual RMDs must be taken each subsequent year no later than December 31.

How do I calculate my required minimum distribution?

The RMD amount depends on your age, the value of the account(s), and your life expectancy. You can use the IRS Uniform Lifetime Table (or the Joint and Last Survivor Table, in certain circumstances) to determine your life expectancy. Most investment companies do the calculation for you.

Clients of A&I have the RMD calculated automatically!

To calculate your RMD, divide the value of your account balance at the end of the previous year by the number of years you’re expected to live, based on the numbers in the IRS table. You must calculate RMDs for each account that you own. If you do not take RMDs, then you may be subject to a federal income tax penalty on the amount that should have been withdrawn. The penalty used to be 50%! After the tax laws were passed at the end of 2022, this penalty was reduced to 25%. Furthermore, the penalty is reduced to 10% if the taxpayer acts quickly to remedy the situation.

Remember that distributions from tax-deferred retirement plans are subject to ordinary income tax.

Waiting until the April 1 deadline in the year after reaching the required beginning age is a one-time option and requires that you take two RMDs in the same tax year. If these distributions are large, this method could push you into a higher tax bracket. It may be wise to plan ahead for RMDs to determine the best time to begin taking them.

Can an account owner withdraw more than the RMD?

You make only one RMD, but an account owner can make as many distributions as they want.

If an account owner does not withdraw an RMD, they will be subject to a penalty. Prior to 2023, the penalty was 50% on the amount not withdrawn. For example, if an account owner’s RMD is $10,000 and they withdrew $5,000, they would be subject to a $2,500 penalty (50% of the $5,000 not withdrawn). After the tax law changes in 2022, this penalty was reduced to 25%. And, if the account owner acted timely to correct the situation, the penalty was reduced to 10%.

There are a few exceptions to this rule. If an account owner is still working and their employer offers a retirement plan, they may be able to defer withdrawals from their retirement account until after they retire. Additionally, if an account owner is taking distributions as part of a SEPP (Substantially Equal Periodic Payment) plan, they may be able to withdraw more than the RMD amount. However, these exceptions are rare and most account owners will not be able to withdraw more than the RMD amount without facing penalties.

How are RMDs taxed?

The RMD amount is taxed as regular income in the year it is withdrawn. For example, if an account owner’s RMD is $10,000 and their marginal tax rate is 25%, they will owe $2,500 in taxes on the RMD amount.

It is important to note that the RMD amount is not eligible for the long-term capital gains tax rate. This means that even if the majority of an account owner’s retirement account is composed of long-term investments (e.g. stocks, bonds, etc.), the RMD amount will still be taxed at their marginal tax rate.

There are a few ways to minimize the taxes owed on an RMD. One way is to take distributions from other accounts first (e.g. taxable brokerage accounts, Roth IRA, etc.), which will lower an account owner’s overall marginal tax rate. Additionally, some account owners may be able to have their RMD amount directly deposited into a qualified charitable organization, which would allow them to avoid paying taxes on the RMD amount altogether.

Learn about the Qualified Charitable Deduction QCD here.

It is important to consult with a financial advisor or tax professional to determine the best way to minimize the taxes owed on an RMD.

Who calculates the amount of the RMD?

The RMD amount is calculated by the account owner’s financial institution. The calculation is based on the account balance at the end of the previous year and the account owner’s life expectancy. The financial institution will send a notice to the account owner each year informing them of their RMD amount. The account owner must then make a withdrawal for that amount by December 31st of that year.

What happens if an account owner doesn’t take their RMD?

If an account owner does not take their RMD by December 31st, they will be subject to a penalty. Prior to 2023, there was a 50% penalty on the amount that should have been withdrawn. For example, if an account owner’s RMD is $10,000 and they do not take a distribution for that amount, they will owe a $5,000 penalty. After the tax law changes of 2022, the penalty was reduced to 25% or 10% if the account owner acts promptly to correct the error.

Additionally, the account owner will still be required to take the RMD amount in the following year. So, if an account owner did not take their RMD in 2023, they would be required to take it in 2024 AND pay the 25% penalty.

It is important to note that there is no grace period for taking an RMD. The account owner must take their RMD by December 31st of each year or they will face penalties.

What are some strategies for minimizing the taxes owed on an RMD?

There are a few ways to minimize the taxes owed on an RMD. One way is to take distributions from other accounts first (e.g. taxable brokerage accounts, Roth IRA, etc.), which will lower an account owner’s overall marginal tax rate. Additionally, some account owners may be able to have their RMD amount directly deposited into a qualified charitable organization, which would allow them to avoid paying taxes on the RMD amount altogether.

It is important to consult with a Colorado financial advisor or tax professional to determine the best way to minimize the taxes owed on an RMD or for understanding pros & cons of RMD.

The information in this article is not intended to be tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

Help Center

Help Center