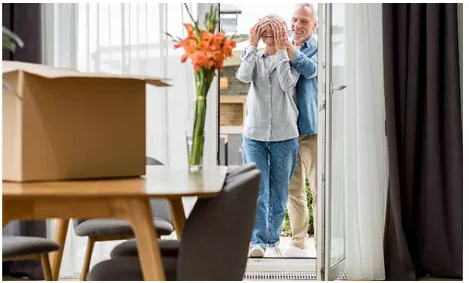

Jim and Sheryl have been clients of the firm for nearly 20 years. They originally came to us for tax advice. Their tax preparer only looked “in the rear view mirror” and they often felt surprised. They wanted everything to be pulled together and organized, but they didn’t have the time or confidence to do it themselves. Both were working, previously married and they were looking forward to helping their grown children plan for marriages and grandchildren too. We:

Often meet on the phone, using Zoom or in-person

Planned for paying for the kids’ marriages

Enabled them to build their dream retirement home

Provide them a retirement income from their investments

Plan for their grandkids future education, whether college-bound or otherwise

We provide their kids financial planning advice as a service as well

Sheryl and Jim call us with any question they have about money. They joke that they “have to have permission” before they make a big purchase. What they are actually saying is that now they have confidence, whenever they want something, whatever it is, they know they can achieve their dream!

Dave and Janet have been clients of our firm for over 10 years. Together, they have run a business for thirty years. Yet, when they first became clients, they felt lost with their personal money. Dave said there were three stages to a life with money: accumulation, retention and giving away. Back then, it was all about protecting and growing their wealth. Today, their financial plans involve a lot of giving. We:

Often meet in person, share emails and talk on the phone

Discuss charitable planning strategies

Talk about the joys of giving to the family without spoiling them

Planning for the business exit and the second generation of ownership

Provide prudent investment portfolio management

Their modesty and generosity make a big impact in the lives of many people. Their church, for example, is financially strong—and most of the members have no idea how much of that strength comes from Dave and Janet.

Help Center

Help Center